What is Stock Market?

The stock market is a platform where investors buy and sell

shares of publicly traded companies. Here are some basics to help you

understand how the stock market works:

1. Stock: A

stock represents ownership in a company.

When you buy a stock, you're buying a small piece of that company.

2. Publicly

Traded Companies: Some companies decide to go public by issuing shares of stock that can be bought and sold by the

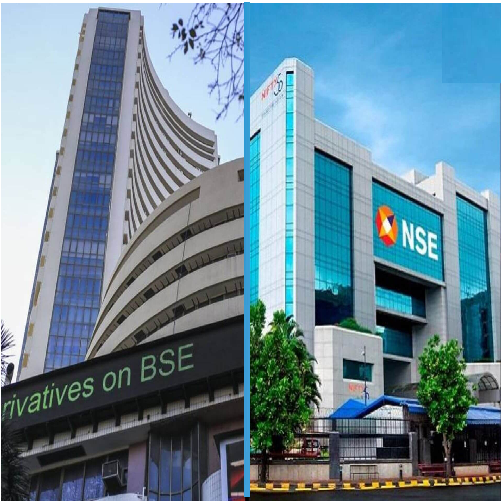

public. These companies are listed on stock exchanges like the National Stock Exchange

(NSE) or Bombay Stock Exchange (BSE).

3. Stock

Exchanges: Stock exchanges are where stocks are bought and sold.

These exchanges provide a centralized platform for

investors to trade securities. The NSE and BSE are two of the most well-known

stock exchanges in India.

4. Stock Price: The

price of a stock is determined by supply and demand. If more people want to buy a

stock than sell it, the price will go up. Conversely, if more people want to

sell a stock than buy it, the price will go down.

5. Market

Capitalization: This refers to the total value

of a company's outstanding shares of stock. It is calculated by

multiplying the stock price by the number of outstanding shares.

6. Stock

Indices: Stock indices like the NIFTY50, BSE SENSEX, and BANKNIFTY

are used to track the performance of a group of stocks. They provide

insight into the overall direction of the stock market.

7. Stock

Market Participants: There are various participants in the stock

market, including individual investors, institutional investors (like mutual

funds and pension funds), traders, and market makers.

8. Trading

Methods: Stocks can be traded through different methods, including

market orders, limit orders, and stop orders. Each method has its own

advantages and risks.

9. Risk

and Reward: Investing in stocks comes with risks, including the

potential for loss

of principal. However, stocks historically have provided higher returns over

the long term compared to other asset classes like bonds or cash.

10. Research and Analysis:

Before investing in stocks, it's important to research and analyze companies to

make informed

decisions. This can involve studying financial statements, analyzing

industry trends, and evaluating the company's management team.

11. Diversification:

Diversifying your investment portfolio by investing in a variety of stocks can

help reduce

risk. This involves spreading your investments across different

industries and types of companies.

12. Long-Term Perspective:

Successful investing in the stock market often requires a long-term

perspective. Trying to time the market or chasing short-term gains can be risky

and may result in losses.